Advanced Fixed Income Strategies for Seasoned Investors

Introduction to Advanced Fixed Income Strategies

Fixed-income investments, such as bonds and similar securities, are crucial for diversifying investment portfolios and managing risk. To access expert guidance on refining your strategies, register for free and start enhancing your fixed-income approach today. This article delves into sophisticated techniques and approaches that go beyond traditional bond investments, focusing on methods that leverage market nuances and advanced financial tools.

Beyond Traditional Bonds: Exploring Alternative Fixed Income Assets

While traditional bonds—government, corporate, and municipal—remain fundamental, alternative fixed-income assets offer additional opportunities. Municipal bonds, for instance, provide tax advantages, particularly beneficial for high-income investors. High-yield bonds, often issued by companies with lower credit ratings, present higher risk but also the potential for higher returns. Emerging market debt, while volatile, can offer attractive yields and diversification benefits. Investors should assess these alternatives based on their risk tolerance and investment goals.

Yield Curve Strategies: Navigating Interest Rate Movements

The yield curve, which plots bond yields across different maturities, provides insights into future interest rate expectations. Advanced strategies involve manipulating portfolio duration in response to anticipated rate changes. A barbell strategy, for example, involves investing in short- and long-term bonds, which can benefit from changes in interest rates. Conversely, a bullet strategy focuses on bonds with similar maturities, aiming to capitalize on stable rate environments. Steepeners and flatteners are additional strategies used to benefit from anticipated changes in the yield curve’s slope.

Credit Risk Management: Techniques for Enhancing Returns

Credit risk, the potential for issuer default, is a significant factor in fixed-income investing. Managing this risk involves assessing credit quality through credit ratings and financial analysis. Investors can employ techniques such as credit default swaps (CDS) to hedge against potential defaults or collateralized debt obligations (CDOs) to diversify exposure. Selecting high-quality issuers and actively monitoring credit conditions are crucial for optimizing returns and managing credit risk.

Leveraging Derivatives for Fixed Income Strategies

Derivatives, including interest rate swaps, futures, and options, offer advanced tools for managing fixed-income investments. Interest rate swaps allow investors to exchange fixed-rate payments for floating-rate payments, adjusting exposure to interest rate changes. Futures contracts can be used to hedge against interest rate movements or to speculate on rate changes. Options on bonds or interest rates provide flexibility in managing interest rate risk and can enhance returns through strategic positioning.

Advanced Duration Management: Techniques and Tools

Duration, a measure of bond price sensitivity to interest rate changes, is a critical factor in fixed-income investing. In a rising rate environment, managing duration becomes crucial to protect against price declines. Techniques such as duration matching, which involves aligning the duration of assets and liabilities, help in managing interest rate risk. Immunization strategies aim to protect a portfolio’s value by matching the duration of bonds with investment horizons. Dynamic duration management adjusts portfolio duration based on interest rate forecasts, providing a proactive approach to interest rate risk.

Integrating Fixed Income with Other Asset Classes

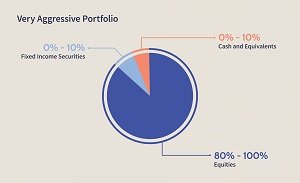

Effective fixed-income investing often involves balancing these assets with equities and alternative investments. Fixed income provides stability and income, while equities offer growth potential. Combining these asset classes can enhance portfolio performance and reduce volatility. Alternatives, such as real estate or commodities, can further diversify risk and improve returns. A strategic approach involves regularly assessing the portfolio’s overall risk-return profile and adjusting allocations based on market conditions and investment objectives.

Case Studies and Real-world Applications

Examining real-world examples helps illustrate the practical application of advanced fixed-income strategies. For instance, during periods of economic uncertainty, investors might have successfully used barbell strategies to benefit from both short-term stability and long-term growth. Conversely, in a rising rate environment, dynamic duration management could have protected portfolios from significant losses. These case studies highlight how strategic adjustments can enhance returns and manage risk effectively.

Future Trends in Fixed Income Investing

The landscape of fixed-income investing is evolving with emerging trends and technological advancements. Innovations such as blockchain and big data analytics are transforming fixed-income markets, offering new ways to analyze and manage investments. The rise of ESG (Environmental, Social, and Governance) investing is also influencing fixed-income strategies, as investors seek bonds aligned with sustainability goals. Staying informed about these trends and adapting strategies accordingly is essential for maintaining a competitive edge in fixed-income investing.

Conclusion

Advanced fixed-income strategies offer seasoned investors opportunities to enhance returns and manage risk effectively. By exploring alternative assets, utilizing sophisticated yield curve strategies, managing credit risk, leveraging derivatives, and integrating fixed income with other investments, investors can navigate complex market conditions. Continuous learning and strategic adjustments are key to leveraging these techniques successfully and achieving long-term investment goals.