Common Mistakes To Avoid While Doing Car Insurance Renewal

Renewing car insurance is essential for every car owner as it protects you financially from unforeseen events. With digitalisation, excessive form filling and waiting in lines for car insurance renewal have been replaced with straightforward and quick applications.

With the convenience, have you ever considered whether you are getting the best deal or the right coverage? Due to the last-minute renewal rush, many of us forget to research, which commonly leads to costly and inadequate coverage.

To avoid these mistakes and ensure your vehicle is protected by a reliable insurer, it is essential to learn about the common errors people make when renewing insurance. In this blog, we’ll learn about the mistakes and how to avoid them.

What are the Common Mistakes to Avoid During Car Insurance Renewal?

Here are some of the common mistakes to avoid to ensure you make the most of the renewal of your car insurance:

Not Comparing Policies

One of the biggest mistakes made during insurance renewal is not researching other insurers and sticking to the old one every year. It is always advised to take some time, get quotes from different companies, and compare the policies. Never go for the plan based on low premiums. Many platforms offer various benefits, rewards, discounts, and features to attract new customers. By avoiding looking around, you’ll miss out on the best deals.

Not Renewing on Time

It is essential to renew the insurance policy on time as driving a car without insurance in India is illegal, and you may have to pay high fines or even be imprisoned. Insurance companies start sending notifications one month before the due date, and it is always recommended to make the renewal on a prior basis before you lose out on coverage.

Skipping Add-Ons

Some leading companies, like Bajaj Allianz, offer valuable add-ons like zero-depreciation cover, engine protectors, key and lock replacements, consumable expenses, 24/7 assistance, and more. These add-ons may increase the premiums but provide extra care for your vehicle, enhance the policy and customise coverage per your needs. Always analyse your insurance needs and choose the ones best suited for your car.

Not Understanding the Coverage

It is always important to read all the documents, terms, and conditions before signing the papers. Check coverage limits, what’s included in the insurance, and whether your vehicle insurance protects against natural disasters, theft, or third-party liabilities. If there’s any confusing point, discuss it with the insurer and ensure the insurance is made according to your needs.

Not Availing of the No Claim Bonus (NCB)

If you haven’t made any claims throughout the insurance period, you are entitled to a No Claim Bonus (NCB) during the renewal. The bonus can reduce your renewal premium by up to 50%. Hence, when renewing your car insurance, check whether you are eligible for NCB and maximise the savings.

Not Sharing the Right Information

Ensure the details you provide while making a car insurance renewal are accurate. Providing incorrect information, like the vehicle’s driving history, may result in rejected claims or higher premiums. Always be transparent when sharing details with the insurer.

Pro Tips for Smooth Insurance Renewal

- Compare policies and offerings from different companies.

- Set reminders on your smartphones or calenders for at least four weeks before the due date.

- Review your policy regularly and make sure it still meets your needs.

- File claims for all damages.

- Be transparent with your policyholder and keep the information updated.

- Take advantage of all the discounts and benefits offered by the insurer and check whether you are eligible for NCB.

Final Thoughts

Renewing car insurance isn’t just about paying the premium. It’s also about knowing your policy, looking for better deals, and making necessary updates to ensure your vehicle is fully protected.

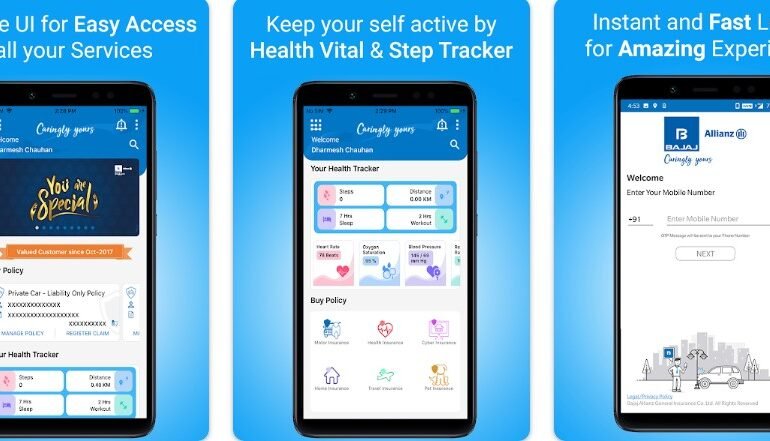

Reliable digital platforms like Bajaj Allianz offer transparent terms and conditions, making the renewal process extremely convenient and quick. Take your time, research, and avoid making the above-mentioned mistakes. Ensure the policy suits your needs, and make the most of insurance to enjoy peaceful and stress-free driving.