Invoice Financing: Unlocking The Secret For Successful Cash Flow and Accelerate Your Business Growth

Invoice financing serves as a savvy financial strategy employed by businesses to effectively manage their cash flow dynamics. The process involves the sale of invoices to a third party, commonly known as a ‘factor,’ at a discounted rate. This transformative manoeuvre converts unpaid customer invoices into immediate capital, mitigating the impact of cash shortages and facilitating the timely meeting of operational expenses.

Importance and Benefits

Invoice financing emerges as a critical instrument in promoting operational continuity by providing businesses with immediate access to funds entangled in unpaid invoices. The significance of this strategy lies in its ability to ensure a steady cash flow, vital for daily expenses, and fostering overall growth. Furthermore, it acts as a shield against the risks associated with late or failed payments, thereby enhancing financial stability and fostering robust relationships with suppliers and customers.

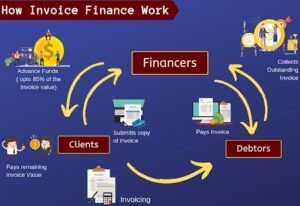

Ways Invoice Financing Works

This financing method allows businesses to borrow against the amounts due from customers by selling their invoices to a finance company, known as the factor, at a discount. The factor then collects the full invoice amount directly from customers, providing the business with an instant influx of cash.

Types of Invoice Financing: Factoring & Discounting

Invoice financing manifests in two distinct types: factoring and discounting. Factoring involves the sale of invoices to a third party responsible for managing the collection process. On the contrary, discounting allows businesses to retain control over collections while borrowing against the invoice’s value. Both types offer a lifeline by advancing significant invoice values, thus improving overall cash flow.

Distinguishing Invoice Financing from Traditional Loans

Unlike traditional loans, which hinge on a business’s creditworthiness and adhere to fixed repayment schedules, invoice financing enables businesses to borrow against amounts due from customers. The collateral used and the speed of liquidity becomes the primary distinguishing factors between these financial approaches.

Role of Invoice Financing in Improving Cash Flow

Invoice financing plays a pivotal role in bolstering cash flow for businesses. By allowing them to sell unpaid invoices to a financier, it generates immediate cash, aiding in managing operational expenses, and employee salaries, and fueling growth investments.

Practical Examples of Using Invoice Financing

Across various industries, invoice financing proves its versatility in enhancing cash flow. Retail businesses can leverage it to navigate inventory and seasonal demands while manufacturing companies utilize it for procuring raw materials. In construction, it serves as a means to cover project costs before receiving payments from clients.

Benefits and Potential Risks

While invoice financing stands as a potent tool for converting receivables into instant cash, and ensuring continuous operations, businesses must navigate potential risks. These include associated costs, the potential loss of client control, and the danger of clients failing to fulfil their invoice obligations, leading to business losses.

Impact of Invoice Financing on Business Growth

By improving cash flow, invoice financing acts as a catalyst for business growth. The immediate availability of funds empowers businesses to invest in new products, staff, or resources, leading to enhanced output and competitiveness.

Case Studies of Positive Effects

Numerous case studies underscore the positive impact of invoice financing on business expansion. Mid-sized companies have expanded production lines and witnessed increased profits by leveraging funds from invoice financing, addressing cash-flow challenges and fostering growth.

Evaluation of Invoice Financing Providers

When selecting a reliable invoice financing provider, businesses must consider factors such as credibility, experience, transparency in rates and fees, customer service, technological capabilities, and flexibility in offering customized financing solutions.

Top-rated Invoice Financing Providers

BlueVine, Fundbox, and American Express Working Capital stand out as top-rated invoice financing providers. Each brings unique advantages, such as fast funding, high credit limits, quick approvals, transparent pricing, and tailored solutions for larger businesses.

Implementing Invoice Financing in Your Business

Implementing invoice financing involves registering with a reputable firm, providing detailed information about invoices and clients, and receiving a percentage of the invoice value upfront. Maintaining accurate records, timely invoicing, and fostering good relationships with clients are essential for effective leveraging.

Future Trends in Invoice Financing

The future of invoice financing is poised for digitization and automation, driven by technological advancements like artificial intelligence, blockchain, and machine learning. These innovations aim to streamline processes, minimize risks, increase accuracy, and enhance speed, ensuring a more accessible and efficient landscape for businesses.

In conclusion, invoice financing emerges as a powerful financial tool, providing businesses with the means to unlock immediate cash flow, manage operational expenses, and fuel growth without the constraints of traditional loans. By converting unpaid invoices into instant capital, businesses can navigate cash shortages, mitigate risks, and strategically position themselves for sustained success. The dynamic landscape of invoice financing, marked by technological advancements and a range of reliable providers, underscores its role as a catalyst for business growth and financial stability. As businesses embrace this innovative approach, careful consideration of risks and selection of reputable providers is crucial for maximizing the benefits of invoice financing.