The Evolution of Diversification: Past, Present, and Future

Introduction

Diversification is a fundamental concept in investing, aimed at managing risk and improving returns by spreading investments across various assets. This strategy helps to reduce the impact of a poor-performing asset on the overall portfolio. Understanding the evolution of diversification provides insights into its significance and effectiveness in different economic contexts. To access additional tools and information that can enhance your investment strategies, click this link for more details.

Historical Perspective: The Origins of Diversification

Early Concepts of Diversification

Diversification has its roots in ancient trade practices, where merchants would spread their goods across multiple routes to mitigate the risk of loss from theft or natural disasters. In financial markets, diversification began to take shape as early as the 17th century with the development of stock exchanges. The first recorded use of diversification in investing can be traced to the 18th century when investors started allocating funds across different types of securities.

Diversification in Traditional Investment Portfolios

In the 19th and early 20th centuries, diversification was primarily limited to stocks and bonds. Investors typically spread their investments within these asset classes to manage risk. For example, a typical portfolio might include a mix of industrial stocks and government bonds. This traditional approach to diversification is aimed at balancing risk and return within a relatively narrow range of investment options.

The Modern Era: Diversification in the 20th Century

The Rise of Modern Portfolio Theory

The 1950s marked a turning point with the introduction of Modern Portfolio Theory (MPT) by Harry Markowitz. MPT revolutionized diversification by introducing the concept of optimizing a portfolio to achieve the best possible return for a given level of risk. Markowitz’s theory emphasized the importance of combining assets with low or negative correlations to reduce overall portfolio risk. This approach laid the groundwork for contemporary diversification strategies.

Diversification Across Asset Classes

By the late 20th century, diversification expanded beyond traditional stocks and bonds to include real estate, commodities, and alternative investments. The introduction of mutual funds and exchange-traded funds (ETFs) further democratized access to diversified portfolios, allowing individual investors to invest in a broad range of assets without needing to manage each investment directly.

The Age of Technology: Diversification in the 21st Century

Technological Advancements and Their Impact

The advent of technology has transformed diversification strategies. Algorithmic trading and sophisticated data analytics enable investors to identify patterns and optimize portfolios with unprecedented precision. Technology also facilitates real-time monitoring and adjustment of portfolios, enhancing the ability to respond quickly to market changes.

Globalization and Cross-Border Diversification

Globalization has expanded diversification opportunities by allowing investors to access international markets. Cross-border diversification helps spread risk across different economies, reducing the impact of regional economic downturns. However, it also introduces new challenges, such as currency risk and geopolitical instability, which investors must manage.

Emerging Trends: The Future of Diversification

Alternative Investments and New Asset Classes

The 21st century has seen the rise of alternative investments like cryptocurrencies, private equity, and venture capital. These new asset classes offer the potential for high returns but also come with unique risks. Diversifying into alternatives can enhance portfolio returns and reduce correlation with traditional assets. Additionally, Environmental, Social, and Governance (ESG) criteria are becoming increasingly important in diversification strategies, reflecting a shift towards sustainable investing.

Innovations in Diversification Strategies

Artificial intelligence (AI) and machine learning are set to redefine diversification. These technologies can analyze vast amounts of data to identify investment opportunities and manage risk more effectively. Future diversification strategies are likely to incorporate AI-driven insights and predictive analytics to optimize portfolio performance.

Case Studies: Diversification in Action

Successful Diversification Examples

One notable example of successful diversification is the growth of tech-focused mutual funds that have balanced investments across various technology sectors. These funds have achieved strong performance by diversifying within a high-growth industry. Another example is the inclusion of real estate investment trusts (REITs) in portfolios, providing exposure to real estate without the need for direct property ownership.

Lessons Learned from Diversification Failures

Not all diversification efforts succeed. The collapse of diversified portfolios during the 2008 financial crisis highlighted the limitations of relying on certain asset classes that were correlated during market downturns. These failures underscore the importance of continually reassessing and adjusting diversification strategies to address evolving market conditions.

Practical Tips for Implementing Effective Diversification

Building a Diversified Portfolio

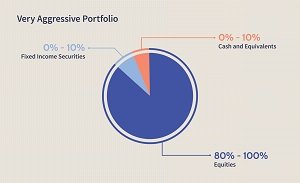

To build an effective diversified portfolio, investors should include a mix of asset classes, such as equities, bonds, real estate, and alternative investments. It’s essential to select assets with varying levels of risk and return to balance the overall portfolio. Additionally, regular rebalancing is crucial to maintain the desired risk level and adapt to market changes.

Avoiding Common Pitfalls

Common mistakes in diversification include over-concentration in similar assets or geographic regions, leading to increased risk. Another pitfall is neglecting to account for the correlation between assets. Investors should be aware of these pitfalls and seek to build truly diversified portfolios by including a wide range of asset types and sectors.

Adjusting Your Diversification Strategy Over Time

Diversification strategies should evolve with changes in market conditions, economic cycles, and personal financial goals. Regularly reviewing and adjusting the portfolio helps ensure it remains aligned with the investor’s risk tolerance and investment objectives.

Conclusion

Diversification has evolved significantly from its early roots in ancient trade practices to a sophisticated strategy incorporating modern technology and global opportunities. As diversification continues to adapt to new trends and technologies, investors can enhance their portfolios’ resilience and performance. Understanding this evolution helps investors make informed decisions and optimize their investment strategies for future success.